Cost Of Living Acceleration

(C.O.L.A.)

New Castle County Police Alumni Association

Memorandum

To: All members of the NCCPAA

Ref: Police COLA study

From: Michael A. Terranova, President

Date: June 24, 2009

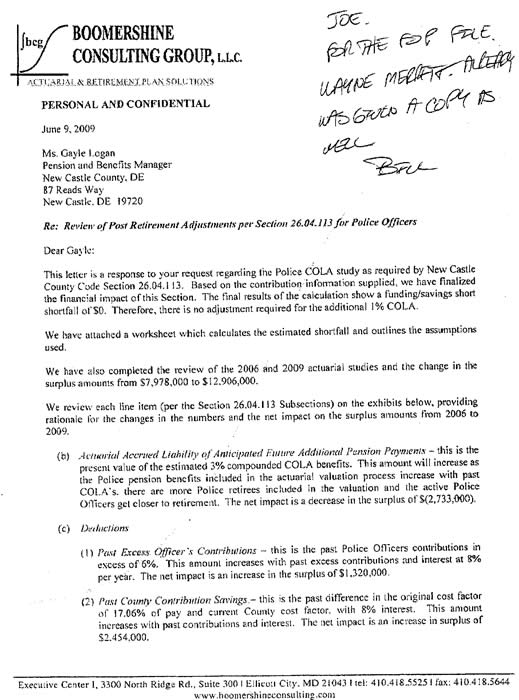

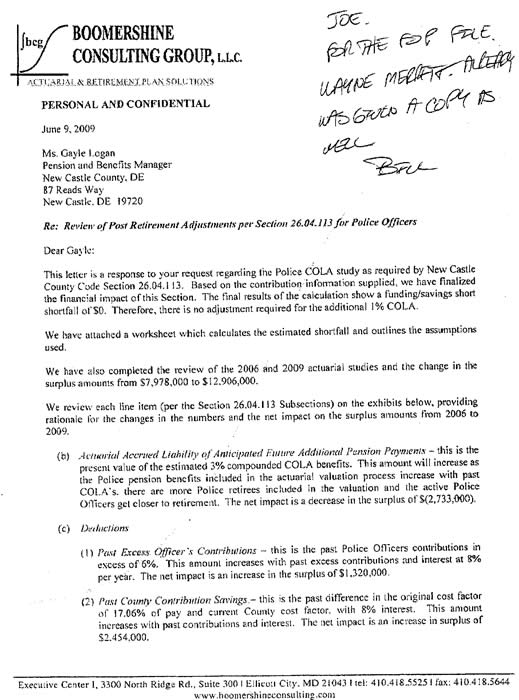

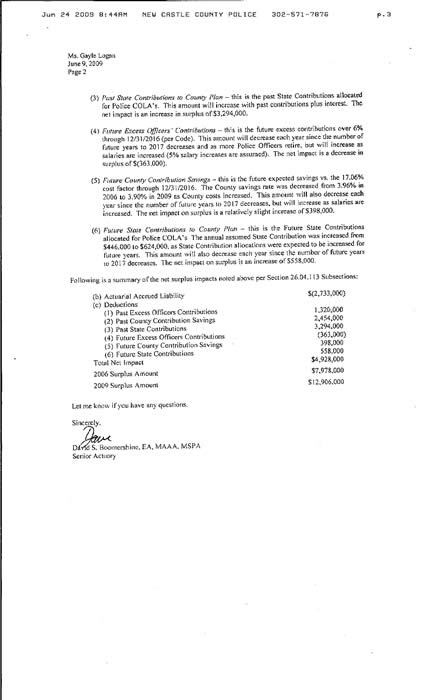

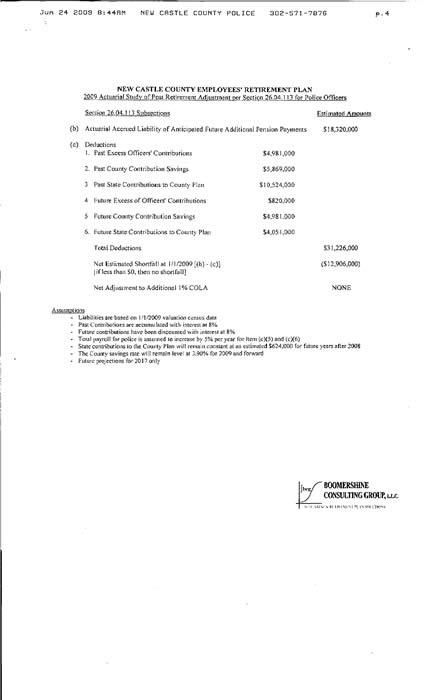

The New Castle County just received a letter from David Boomershine, Senior Actuary, Boomershine Consulting Group, regarding the review of Post Retirement Adjustment per Section 26.04.113 for Police Officers. It reads in part as follows:

“Based on the contribution information supplied, we have finalized the financial impact of this Section. The final results of the calculation show a funding/saving shortfall of $0. Therefore, there is no adjustment required for the additional 1% COLA.

We have also completed the review of the 2006 and 2009 actuarial studies and the change in the surplus amounts from $7,978.000 to $12,906,000.”

Therefore, we are in good shape for another 3 years!

|

From: Robert Jameson Date: 02/07/05 14:55:19 To: Mike Riley Subject: COLA

Mike -

A brief synopsis of our COLA:

In the late 1980's, a group of retired Wilmington police and firefighters formed a Task Force to lobby the General Assembly and the City for a pension increase. As Lodge #5 Legislative Chairman, I was appointed to work with the Task Force by Pete Kotowski who was Lodge # 5 president.

The group successfully passed a bill in 1992 that provided for "matching funds" for police and fire pension increases. This was referred to as the "1 for 1" bill; it earmarked funds from the insurance surcharge the state collects to be matched dollar for dollar to any pension increase that the county or municipal government approved.

The other aspect of this legislation was that governments that were not currently in the State's County/Municipal Police and Firefighter Pension Plan had five years to enroll in order to obtain this funding. (Wilmington was already in; the County joined in 1993.)

As a result of this legislation, Lodge # 5 was successful in passing legislation in 1992 at County Council that briefly:

1) Enrolled new police officers hired after January, 1993 in the State Plan; 2) Set up the COLA (3%) 3) Increased the active duty officers, still in the plan, pension deduction from 6% to 8% (Which was reduced to 7.5% at a later date.)

All the costs estimates where based upon the employee contributions and the matching funds from the State. (There was no was no direct costs for the County; however their contribution rate for new Hirees into the State Plan was higher than the contribution rate into the County plan.)

In 1996, the Wilm Task Force and the FOP pushed for additional funding due to the fact the City had only increased pension payments one time. (Unlike the County, the City failed to provide for an annual COLA and is at the "pleasure" of the City administration for budgeted pension increases.)

Legislation was passed which increased the matching funds from "1 for 1" to "3 for 1". This significantly increased the State's contribution to our COLA.

At no time did we (FOP/County Council/Pension Board) assess the impact on our COLA. Now we have a significant surplus ($16 million) and it is time to have a financial assessment of the COLA. If the funding is there, than a plan should be put into legislation to pass the benefits to our members. (Possibly, a bigger COLA once retired 10 years and another bump at 20.)

The issue needs be discussed.

Bob J.

From: Mike Riley Date: 02/07/05 15:05:11 To: Robert Jameson Subject: COLA

Bob,

1) What is meant by... "It earmarked funds from the insurance surcharge the state collects"? 2) From what money? 3) And what % of it goes to the COLA Fund for our Retirees?

2) Do you know what year the pension deduction was reduced to 7.5%?

Mike |

From: Robert Jameson

Date: 02/08/05 04:45:08

To: Mike Riley

Subject: Re: COLA

Mike -

Question (1) - The State has a 2% surcharge on any insurance policy written.

A portion of it goes to the Fire Companies; another portion goes to county and local governments for police pensions; the rest went to the General Fund. We had a piece of the part that went to the General Fund (.25) earmarked for COLA.

Question (2) - The police employee's contribution was reduced from 8% to 7.5% in Jan. 1998 and was further reduced to 7% in Jan., 2003. (No other reductions are provided for.)

(It interesting to note that these reduction in employee contributions were based on the estimates that the fund would be financially solvent - based upon employee contributions and the state matching funds of "1 for 1". NO ONE FORSAW THE INCREASE OF STATE MATCHING FUNDS THAT OCCURRED IN 1996.)

Bob J.